Richmond, VA, August 16 2021 — A new survey of Allianz Partners customers found they are growing more bullish on future travel plans. The travel insurance and assistance provider found that two-thirds of its customers plan to take a trip between now and November, and that a majority feel confident in resuming pre-COVID activity levels for travel, including a return to cruising by the end of 2021. The number of customers planning trips in 2021 tripled in July, compared to those in February who were planning trips for later this year.

According to Allianz Partners USA’s survey*, 66% of customers anticipate traveling in the next three months (by the end of October). Comparatively, when asked the same question in a similar survey in February 2021, 22% of customers felt they would travel within that same timeframe. Additionally, uncertainty over future travel has dropped by more than half, with just 7% of customers responding in the July survey they were not sure when they would next travel, versus 21% in February.

When asked how long it would take to feel confident enough to resume travel at ‘pre-COVID-19 activity levels,’ a majority of respondents cited they were ‘confident now’ about staying in a hotel (84%), flying on an airplane (79%), staying in a rental property (78%) and traveling on a train (70%). Four in 10 (39%) customers said they were confident now about taking a cruise, with a higher citation among customers from the travel advisor retail channel customers, where 47% responded they were confident about taking a cruise now. More than half (53%) of respondents would feel comfortable to resume their ‘normal’ cruise activity levels by the end of 2021.

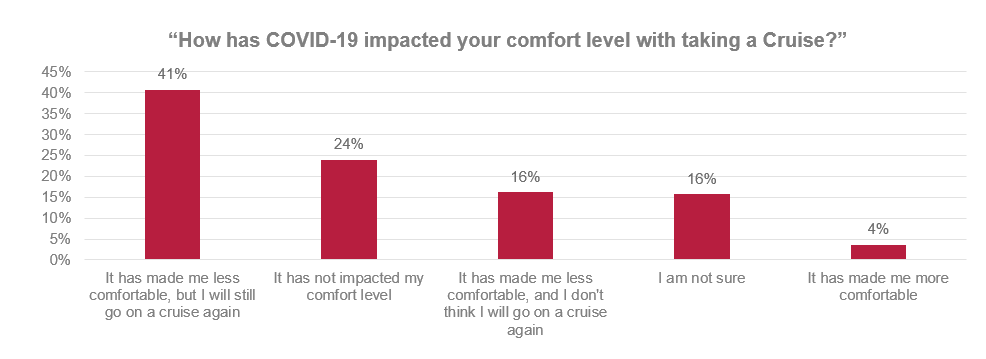

The survey revealed that customers plan to fly (67%, down from 71%) or drive (19%, down from 20%) to reach their destination, and cruising received a boost with 11% who plan to travel by cruise ship, compared to 7% in February. When asked about the effect COVID-19 has had on customers’ comfort level to take a cruise, almost a quarter (24%) indicated it has not impacted their comfort level, and of those who said they were less comfortable, 72% still plan to cruise again.